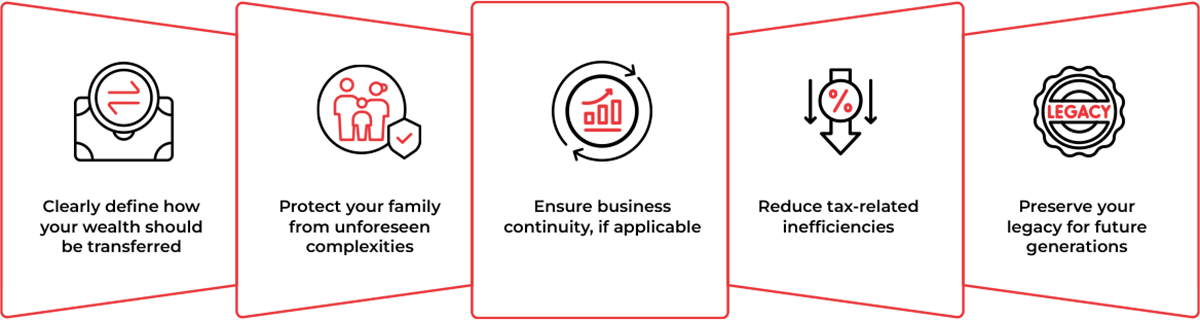

Succession planning is one of the most important pillars of long-term wealth management. It ensures that your assets, responsibilities, and legacy are transferred smoothly to the next generation without conflict, ambiguity, or financial disruption.

At Arthashastra Investments, we help you create a clear and legally sound succession plan that reflects your values, protects your family, and maintains continuity of your wealth. Our approach brings discipline, documentation, and foresight to help you plan the future with confidence and peace of mind.

Succession planning is not just about distributing assets; it is about ensuring that your financial and emotional intentions are respected. Without a well-structured plan, families often face legal challenges, delays, and unnecessary disputes.

A properly drafted will simplifies asset distribution and ensures your wishes arehon oured. We guide you through the documentation process to help eliminate ambiguity and secure your family’s future.

Ensuring all your financial instruments—such as insurance policies, investments, and bank accounts—have correct nominations prevents delays and disputes later. We help align your nominations with your overall wealth strategy.

For families with significant estates or complex assets, a trust can provide stability, tax efficiency, and a seamless transition. We help you understand when a trust is appropriate and how it can strengthen your succession plan.

For entrepreneurs and business owners, planning leadership and ownership transition is crucial. We assist in building strategies that provide continuity while preserving your business legacy.

We bring clarity and structure to a topic that is often emotionally sensitive. Through consultations, asset reviews, and goal discussions, we create a roadmap that ensures your wealth moves forward in the right hands, at the right time, with the least possible friction.

Our role is to simplify decisions, streamline documentation, and help you plan a future that reflects your principles and priorities.